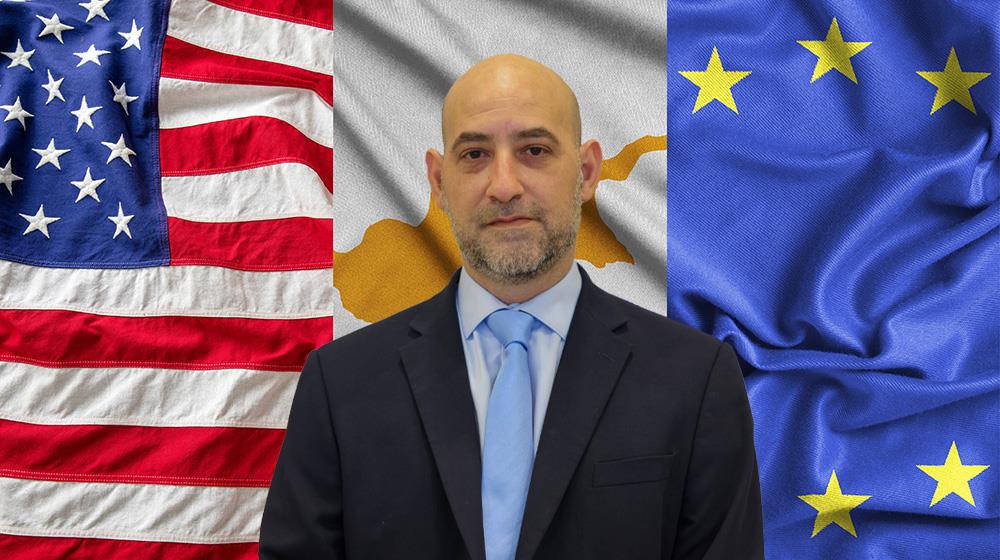

"Cyprus finds itself in a delicate position. While the broader EU–US deal brought relief by averting a full-scale trade war, the 15% tariff baseline still poses challenges for smaller economies like Cyprus that rely heavily on specific export categories," the Executive Director of the American Chamber of Commerce in Cyprus (AmCham) Pantelis Pantelides suggests.

Asked to comment on the recent development and its potential impact on Cyprus, Pantelides told CBN, "Cyprus exported over €22 million worth of goods to the US in 2024, with halloumi cheese alone accounting for €6.4 million. Other key exports include electrical equipment, olive oil, and wine—all of which are now subject to higher tariffs. These sectors, especially dairy and agri-food producers, are bracing for reduced competitiveness in the US market."

Among other things, he also elaborated on the other sectors in Cyprus that are likely to be impacted, while, in addition, sharing his view on the wider implications of the agreement on a European and global scale.

Let's begin with the fundamentals. What are the main parameters of the EU–US trade agreement?

At its core, the agreement sets a 15 percent baseline tariff on nearly all EU goods entering the United States. That includes automobiles, pharmaceuticals, and semiconductors. However, the 50 percent tariffs on EU steel, aluminum, and copper remain in place for now, although there are talks of introducing tariff rate quotas to ease the strain. On the investment front, the EU has pledged $600 billion in American industries by 2029 and is committed to purchasing $750 billion worth of US energy products, especially liquefied natural gas and renewables.

Additionally, tariffs affecting EU aircraft, certain chemicals, and drug generics will revert to pre-January levels. The pact also commits both sides to collaborate on supply chain security, tackle global overcapacity in strategic metals, and explore future regulatory alignment on artificial intelligence, data governance, and digital trade.

This pact is more than a tariff deal—it’s a strategic recalibration of values, power, and priorities across the Atlantic. While it avoids economic escalation and boosts energy cooperation, it also exposes consumer vulnerabilities, sectoral imbalances, and internal EU dissent. With future negotiations still unfolding, the agreement feels less like a full treaty and more like a diplomatic placeholder, bridging today’s needs with tomorrow’s realignment.

That’s a broad scope. How does this pact reshape EU–US relations?

It signals a de-escalation in trade tensions and opens the door for closer diplomatic cooperation. On one hand, it strengthens the transatlantic posture toward geopolitical adversaries. On the other hand, it raises strategic concerns—particularly about the EU’s growing dependence on US energy and defense sectors. Several European leaders have voiced fears that the agreement undermines the bloc's competitiveness. There's also discontent over the lack of reciprocity; EU tariffs on US exports haven’t been reduced in equal measure, leading to questions around fairness and strategic balance, creating internal friction

Moreover, the absence of a legally binding framework means trust remains fragile, and internal divisions within the EU are starting to surface.

Ultimately, this pact is less about economic efficiency and more about strategic solidarity—a mutual acknowledgment that in today’s fractured world, reliable partners matter more than perfect terms. Whether it becomes a sturdy bridge or a political patch job will depend on how both sides handle the next round of negotiations.

Why do EU leaders feel the agreement is unfair?

The new baseline of 15% still far exceeds the US’s previous average tariff rate of roughly 2.5%, which fuels the perception of unfairness. EU Trade Commissioner Maroš Šefčovič described the agreement as “the best we could get under very difficult circumstances,” acknowledging that the EU had limited bargaining power.

That is the general sense within Brussels that the deal was more about minimizing damage than achieving a balanced outcome, with leaders across the continent seeing the agreement as a strategic concession made under pressure.

While it staved off worse consequences, few believe it reflects a truly reciprocal or fair partnership. French Prime Minister François Bayrou even labelled the deal “submission,” calling it a dark day for Europe. German Chancellor Friedrich Merz warned that the deal could significantly harm Germany’s export-reliant economy, particularly industries like automotive and heavy manufacturing.

And what impact will European consumers feel?

Consumers across Europe are likely to experience rising energy costs driven by expensive US imports. Prices could climb in healthcare and technology sectors, given tariff pressures and shifting supply chains. Uncertainty around economic stability may foster cautious spending habits, and we could see shifts in brand loyalty, with some consumers leaning toward local or non-US alternatives. Environmental concerns are also relevant—large fossil fuel imports from the US could clash with EU sustainability goals.

What are the consequences of the trade agreement for Cyprus?

Cyprus finds itself in a delicate position. While the broader EU–US deal brought relief by averting a full-scale trade war, the 15% tariff baseline still poses challenges for smaller economies like Cyprus that rely heavily on specific export categories.

Cyprus exported over €22 million worth of goods to the US in 2024, with halloumi cheese alone accounting for €6.4 million. Other key exports include electrical equipment, olive oil, and wine—all of which are now subject to higher tariffs. These sectors, especially dairy and agri-food producers, are bracing for reduced competitiveness in the US market.

Cyprus also re-exported €27 million worth of electrical components to the US. These goods, often routed through Cyprus for logistical or tax reasons, now face increased scrutiny and cost, potentially disrupting supply chains.

The tourism and services sectors may also feel indirect effects due to broader EU economic shifts. If consumer spending dips or investment slows across Europe, Cyprus’s service-driven economy could also be affected.

Finally, where is this agreement heading?

The pact is best described as a strategic pause. It's a temporary diplomatic measure to restore dialogue and prevent escalation. The next 12 to 18 months will be crucial. Both sides need to resolve outstanding sectoral disputes, clarify the legal framework, and negotiate more symmetric tariff arrangements. If done successfully, the agreement could mature into a cornerstone of EU–US cooperation. If not, it may remain a provisional fix in an increasingly complex global trade landscape.

Whether diplomacy prevails or pressure mounts, this pact is only the opening chapter of a longer transatlantic reckoning.