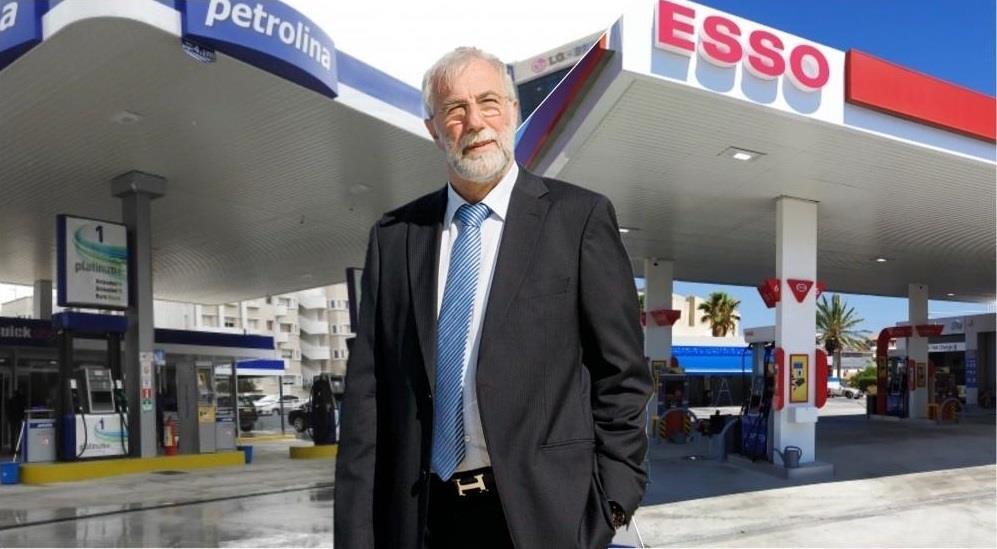

The agreement to acquire ExxonMobil Cyprus Limited (EMCL), a subsidiary of Exxon Mobil Corporation, and the more than 65 Esso petrol stations in the Cypriot market by the Petrolina Group is significant, since, in addition to changing the map of the petroleum retail sector in Cyprus, it gives the company the opportunity to offer lower prices to the public it serves.

"We made the decision to proceed with this move after carefully studying the benefits that will arise for both our company and the consumer public, because with this acquisition we will be able to procure fuel from abroad at lower prices, resulting in the offer of lower prices to the public," the Group's Executive Managing Director and CEO, Dinos Lefkaritis, told InBusinessNews about the mega deal in the petroleum sector.

"Petrolina always aims to offer its customers quality products at good prices," he added.

Asked by InBusinessNews to provide a first comment after the approval of the agreement by the Commission for the Protection of Competition (CPC), Lefkaritis noted that "this is a very time-consuming process, as the CPC examined all the conditions until approval was granted. Now we are moving full speed towards closing the agreement."

"The largest company in the petroleum sector and beyond"

"We are probably the largest company in the petroleum sector and beyond, since the Petrolina Group is also active in other energy sources, such as electricity and photovoltaics," was the statement made by Dinos Lefkaritis, when asked about the importance of the deal in terms of the Group's position in the petroleum market.

It is recalled that the acquisition agreement was signed in November 2024 and in February 2025 a request for notification of a concentration was submitted to the CPC.

As announced, the acquisition agreement is expected to positively affect the prospects and results of the Petrolina Group due to the economies of scale and synergies that can be created based on Petrolina (Holdings) Public Ltd's many years of experience in the petroleum sector.

The acquisition consideration has been agreed at €48.6 million, with 10% of the acquisition consideration (€4.8 million) having been paid as a cash advance simultaneously with the signing of the acquisition agreement.

(Source: InBusinessNews)